oregon tax payment extension

The time for making estimated tax payments for tax year 2020 is. Penalty and Interest Charges on Tax Owed.

If there are any problems here are some of our suggestions.

. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed. Extension payments can also be made online via Oregons Electronic Payment Services. Additionally individual tax payments for the 2020 tax year due on April 15 2021 can be postponed to May 17 2021 without penalties and interest regardless of the.

This includes payment of your 2021 tax liability. You can only make payments to the Oregon Employment Department and the Workers Benefit Fund if youre logged in to your Revenue Online account. The time for making estimated tax payments for tax year 2020 is not extended.

The Oregon tax payment deadline for payments due with the tax year 2019 tax return is automatically extended to July 15 2020. You can make a state extension payment using Oregon Form 20-V Oregon Corporation Tax Payment Voucher. Keep this number as proof of payment.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. The state of Oregon doesnt require any extension Form as it accepts the approved federal extension Form 7004 for the state business income tax returns. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020.

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020. Your browser appears to have cookies disabled. 111 SW Columbia Suite 600 Portland OR 97201-5814.

If you dont have an account sign up now. Enter your Username and Password and click on Log In Step 3. A 1 business income tax on net income for businesses with gross receipts above 5 million.

The measure included two separate taxes. Penalty will be assessed for underpayment unless the extension payment is 90 of the current. You must pay at least 90 of your total tax liability by April 15 2022.

Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. Oregon Tax Extension So Oregon just followed suit with Federal tax payment extension to July 15th - TurboTax listed that you can pay federal on or before July 15th however when I went to input my information for Oregon it still says to schedule a payment on or before April 15th with no option to set it as July 15th. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

Only request an Oregon extension if you dont have a federal extension you owe for Oregon and you cant file your return by the return due date April 18 2022. When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes.

Mail a check or money order. Explore More File Form 7004 and Extend your Federal Business Income Tax Return Deadline up to 6 Months. The 2021 tax deadline to file City of Oregon returns is April 18 2022.

Metro works with the City of Portland to collect these taxes. FEDERAL OR STATE TAX EXTENSIONS WILL NOT BE HONORED. The Oregon income tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

If you dont a 5 late payment penalty may be added to your tax due. Electronic payment from your checking or savings account through the Oregon Tax Payment System. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers.

The service provider will tell you the amount of the fee during the transaction. Once your transaction is processed youll receive a confirmation number. All Oregon residents and businesses are required to file annual City of Oregon income tax returns as well as any businesses with net profit or loss earned within the city.

A 1 marginal personal income tax on taxable income above 125000 for individuals and 200000 for those filing jointly and. The Oregon Department of Revenue announced it is joining the IRS and automatically extending the tax year 2020 filing due date for individuals from April 15 2021 to May 17 2021. Go to Oregon Tax Extension Payment website using the links below Step 2.

Cookies are required to use this site. Extension Clerk Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. The Oregon income tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. With this Bureau to avoid penalty even if you have overpaid. A tax extension gives you more time to file but not more time to pay.

This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension announced. For more information please visit our. Oregon honors all federal automatic six-month extensions of time to file individual income tax returns federal Form 4868 as valid Oregon extensions.

City of Portland Oregon Revenue Bureau.

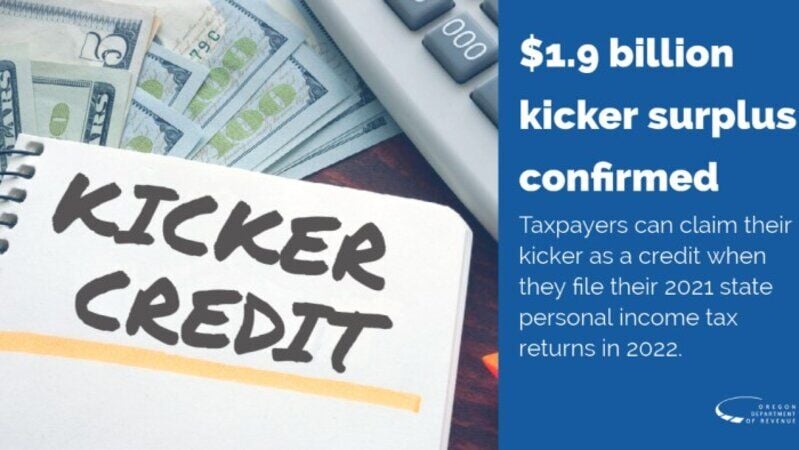

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

E File Oregon Taxes For A Fast Tax Refund E File Com

Oregon Revenue Dept Orrevenue Twitter

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Individuals City Of Oregon Ohio

Blog Oregon Restaurant Lodging Association

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

State Of Oregon Oregon Department Of Revenue Payments

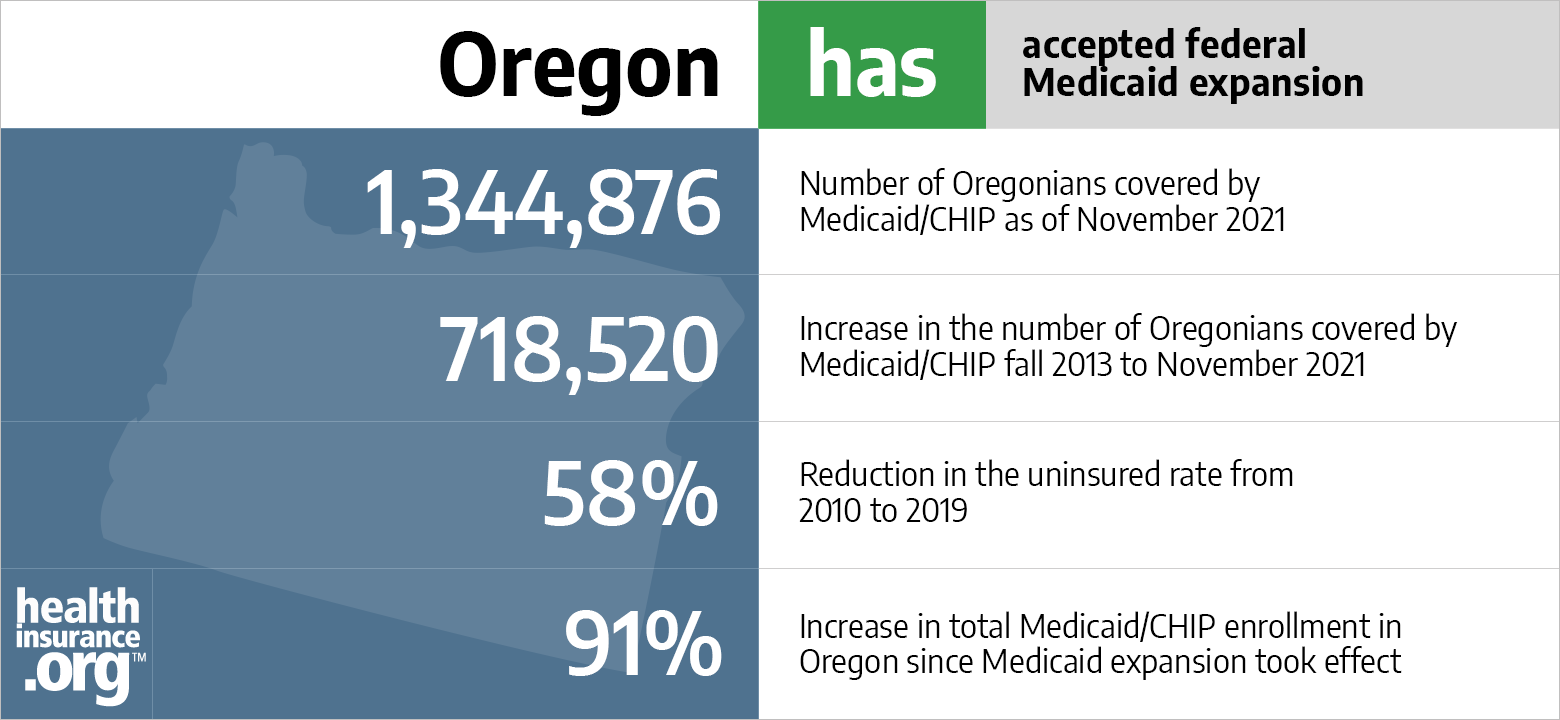

Aca Medicaid Expansion In Oregon Updated 2022 Guide Healthinsurance Org

Oregon Revenue Dept Orrevenue Twitter

Irs Tax Extension To Jan 15 For California Wildfire Victims California Wildfires Prayers Coast Guard Boats

How To Get Update Billing Information For Your Quickbooks Desktop Payroll Subscription Quickbooks Quickbooks Payroll Quickbooks Online

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com